Have you ever wondered how much easier your business life could be with a little bit of virtual assistance? In today’s fast-paced world, balancing the books while trying to run and grow a business can feel like juggling flaming torches. This is where a Virtual Bookkeeper can step in to make your life a whole lot easier. Gone are the days of being buried under piles of receipts and invoices, struggling to decipher the complex world of finance on your own. With a virtual bookkeeper, you are essentially hiring a professional to handle your financial records without them having to physically exist in your workspace. Let’s explore the transformative potential a virtual bookkeeper holds for your business.

What is a Virtual Bookkeeper?

A virtual bookkeeper is someone who provides bookkeeping services remotely, often from a home office. Unlike a traditional bookkeeper, they use cloud-based accounting software to manage your books. This allows them to work with businesses from anywhere in the world, offering flexibility and convenience. Virtual bookkeepers can conduct a wide range of tasks, from simple data entry to managing full sets of bookkeeping for your business.

Benefits of a Virtual Bookkeeper

When you enlist the services of a virtual bookkeeper, you gain a host of advantages. For starters, you can save on office space and resources since they work remotely. Plus, you no longer need to worry about the costly expenses tied to hiring full-time in-house staff, such as benefits and insurance. Virtual bookkeepers often charge an hourly rate or a monthly fee, making it easy to budget for their services.

How Does it Work?

It’s pretty simple; virtual bookkeepers handle your business’s financial records using cloud-based software. This means that everything from tracking transactions to generating reports is managed through a secure online platform that both you and your bookkeeper can access at any time. This layer of accessibility ensures that you have a comprehensive view of your financial health without the complication of scheduling in-office visits.

Roles and Responsibilities of a Virtual Bookkeeper

Understanding what a virtual bookkeeper can do for you is key to making the most out of their services. Their roles can be diverse, depending on what you need, but generally include the following:

Managing Financial Transactions

This is one of the primary functions of any bookkeeper. A virtual bookkeeper will ensure that each transaction is recorded accurately and in a timely manner. This includes dealing with invoices, running payroll, and managing accounts receivable and payable.

Bank Reconciliation

Reconciling your bank statements is critical to ensuring all your financial records are correct. A virtual bookkeeper regularly compares your internal accounts to your external financial statements to ensure everything matches and there are no discrepancies.

Financial Reporting

Your virtual bookkeeper can generate vital financial reports that provide insights into how your business is performing. These reports can help in making informed decisions about where to allocate resources and how to adjust strategies for growth.

Tax Preparation

While not all bookkeepers are accountants, some virtual bookkeepers can assist in preparing tax documents, ensuring you have everything ready for tax season. They help organize your documentation to facilitate a smoother process when working with your tax accountant.

Choosing the Right Virtual Bookkeeper for You

It might feel daunting to choose a virtual bookkeeper, but a few key considerations can help guide you to the right fit for your business.

Skills and Experience

Look for someone with experience in your industry as they will have a better understanding of the unique financial challenges you may face. Also, ensure they are proficient in the specific accounting software you use.

Clear Communication

This goes without saying, but a virtual bookkeeper must have excellent communication skills. Since they are working remotely, the ability to convey information clearly and promptly is crucial.

Reliability and Trustworthiness

You are placing significant trust in someone who will handle your financial information. Seek testimonials or case studies of their previous work to gauge how reliable they are.

Technology and Tools

Ensure they are familiar with the latest bookkeeping technologies. Familiarity with apps and cloud-based solutions is essential to streamline processes effectively.

Technology Behind Virtual Bookkeeping

The gradual shift in how businesses operate has brought forth some sophisticated tools that virtual bookkeepers use to make managing finances more efficient. Cloud-based solutions allow seamless integration of bookkeeping services.

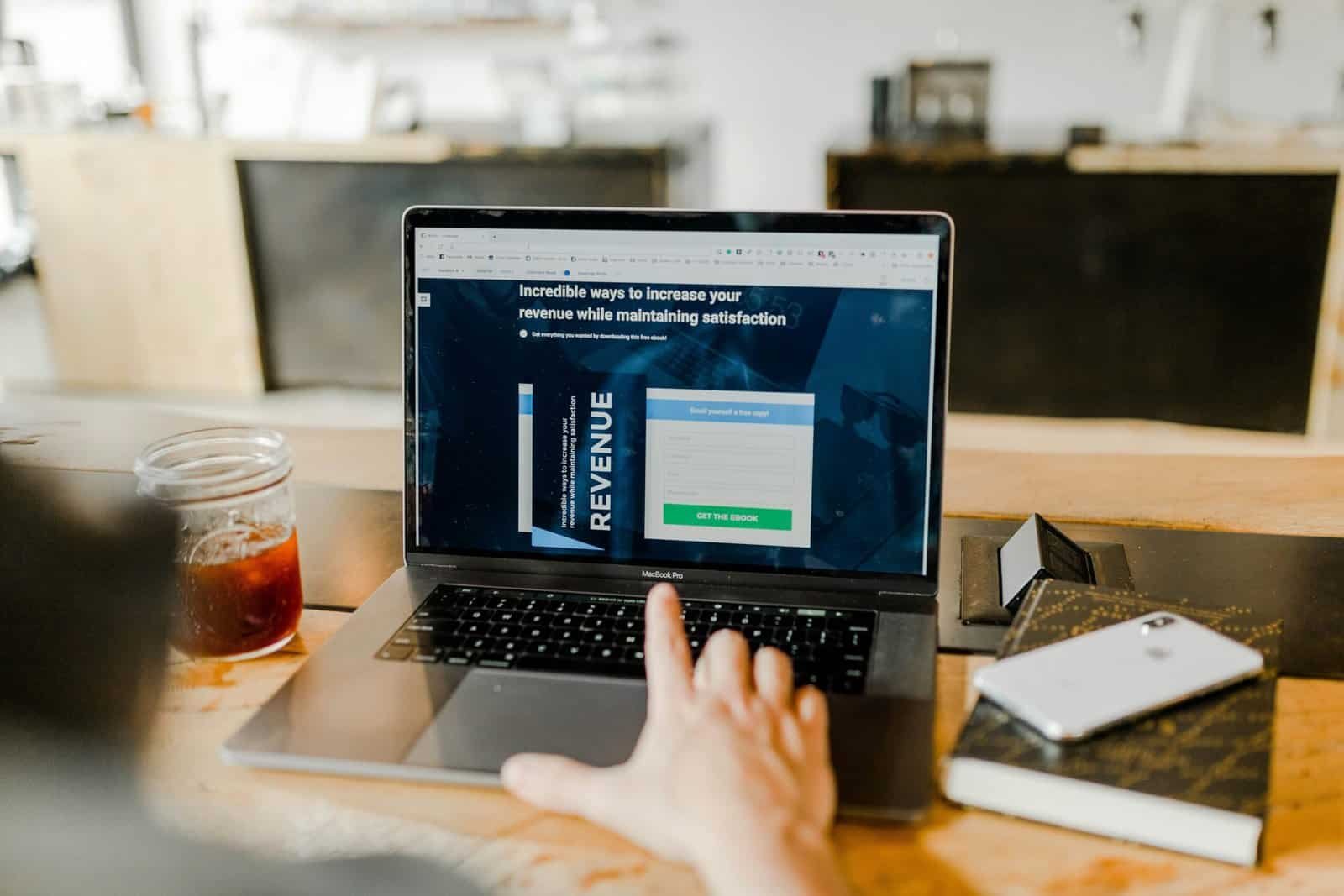

Cloud Accounting Software

Programs like QuickBooks, Xero, and FreshBooks are examples of cloud accounting software, which are becoming the standard tools for virtual bookkeepers. They allow bookkeeping to be done anywhere with internet access while ensuring data security and integrity.

Communication Platforms

To keep in touch effectively, virtual bookkeepers and their clients may use platforms such as Zoom, Slack, or Microsoft Teams. These tools keep communication lines open, suggesting an inclusive workspace despite the physical distance.

Document Sharing and Storage

Google Drive or Dropbox are commonly used for document storage and sharing. They make it possible for you and your bookkeeper to access financial documents as needed, maintaining transparency and easy tracking.

What to Expect from a Virtual Bookkeeper

It’s essential to know precisely what kind of service you’ll get when hiring a virtual bookkeeper. The more you understand about how they work, the more effectively you’ll integrate their support into your business processes.

Regular Updates

A good virtual bookkeeper will provide you with regular updates on your financial status—including progress reports and any potential concerns they foresee. This ensures that you’re aware of your business’s financial health at all times.

Scalability of Services

As your business grows, so too can the services offered by your virtual bookkeeper. This scalability is invaluable compared to traditional in-house bookkeeping, which might require new hires and additional overhead costs.

Personalization

Expect personalized services tailored specifically to your business needs. It goes beyond mere transaction recording—the customization of services ensures your virtual bookkeeper handles unique challenges effectively.

Challenges You Might Face and How to Overcome Them

Just like any service, virtual bookkeeping is not without its challenges. Being aware of these possible obstacles can help you address them more effectively.

Data Security Concerns

With your financial data floating around in the cloud, it’s natural to be concerned about security. Always ensure your virtual bookkeeper uses secure software and practices best cybersecurity measures to protect your information.

Communication Barriers

Sometimes, communication might not be as seamless as you’d like due to technology missteps or time zone differences. Set a schedule for regular meetings and ensure both sides have reliable communication platforms to facilitate discussions.

Managing Expectations

A virtual setup might not work for everyone immediately. Set clear expectations and mutually agreed-upon performance indicators to ensure both parties know what services are being rendered and the level of performance expected.

Case Studies: Real-Life Benefits of a Virtual Bookkeeper

A few stories can often illustrate advantages more vividly than statistics ever could. So let’s take a moment to reflect on businesses that have gained success through virtual bookkeeping services.

The Small Retailer Turned National Storefront

A small clothing retailer was struggling to manage its finances as it expanded online, juggling stock counts and keeping track of sales invoices. After hiring a virtual bookkeeper, the business saw growth fueled by accurate financial insights and streamlined accounting work, leading to the opening of multiple physical storefronts nationally.

The Startup Achieving Its Financial Goals

A tech startup needing precise budget management to secure further investment turned to a virtual bookkeeper. The customized reports and real-time financial advice provided by the bookkeeper allowed the startup to tailor its operations effectively and received a significant funding round cover not long after.

Conclusion

A virtual bookkeeper can be a pivotal ally in your business’s success story. They offer more than just hands-on experience; they can integrate sophisticated cloud-based tools to give you that cutting-edge advantage. By understanding how virtual bookkeepers operate and the scope of their services, you will not only streamline your business finances but drive sustainable growth. From flexibility, reduced costs, improved data access, and bringing global expertise to your doorstep, virtual bookkeeping offers you a modern solution for traditional challenges.

The decision to outsource your bookkeeping will, inevitably, come down to your specific business needs. But one thing is clear—by leveraging a virtual bookkeeper’s expertise and access to advanced technologies, you can spare yourself from being endlessly tied down by financial minutiae. Instead, you can focus on fostering innovation and taking your business to new heights.