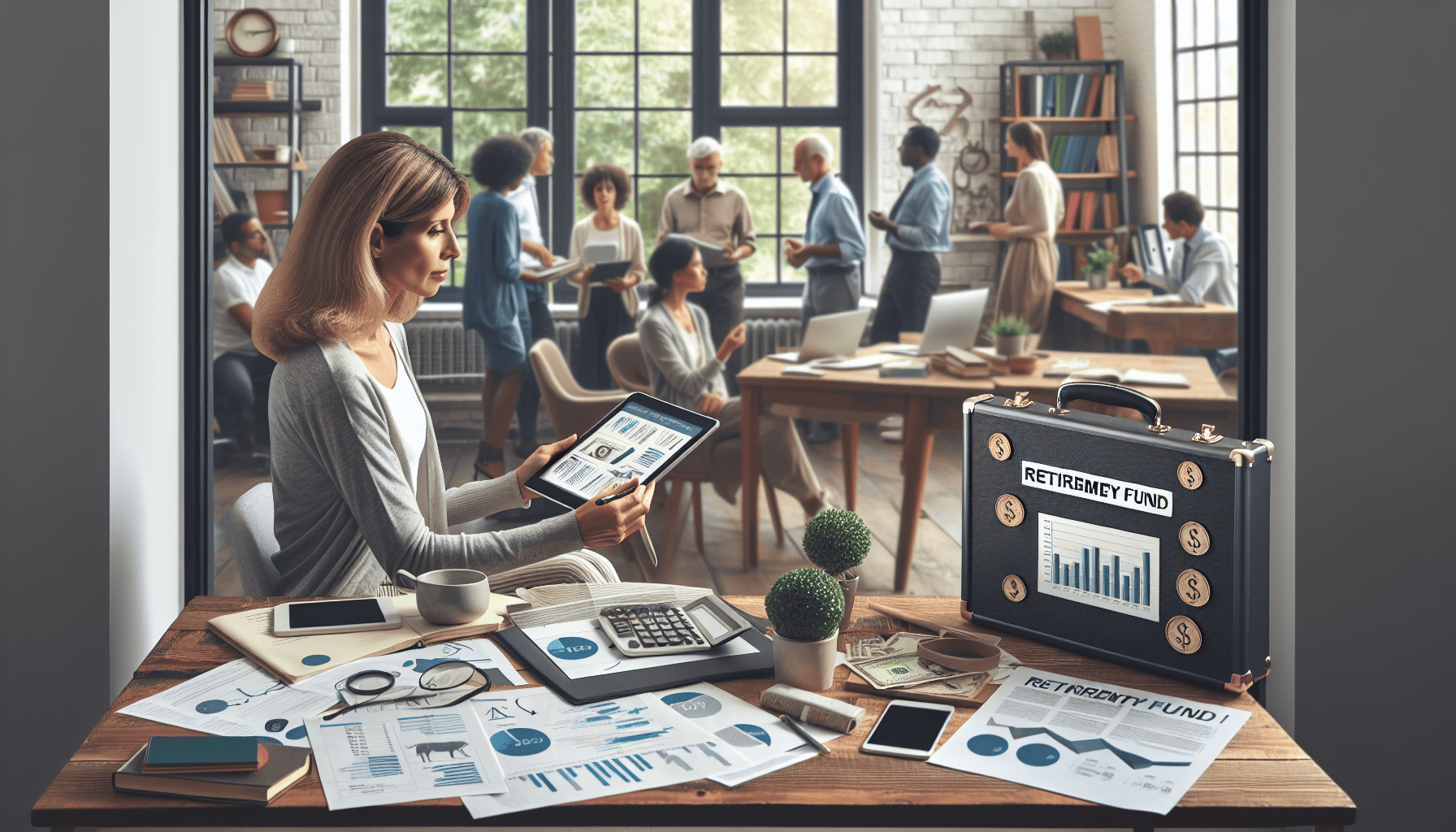

Are you a freelance writer thinking about retirement? As the gig economy continues to grow and evolve, it’s crucial for freelancers to plan for their financial future. In this article, we will discuss five important things to prepare for retirement as a freelance writer. From setting up a retirement savings plan to diversifying your income streams, we will provide valuable tips and insights to help you navigate the retirement planning process. So, if you’re ready to secure your financial well-being and enjoy a comfortable retirement, keep reading.

Financial Planning

Create a Retirement Budget

When it comes to planning for your retirement as a freelancer, one of the first steps you should take is creating a retirement budget. This will help you determine how much money you will need to cover your expenses during your retirement years. Start by evaluating your current spending habits and then consider how those may change once you retire. Take into account factors such as healthcare costs, housing expenses, and leisure activities. By creating a retirement budget, you can gain a clearer picture of how much money you will need to save in order to maintain your desired lifestyle.

Save for Retirement

Saving for retirement is a crucial aspect of financial planning for all individuals, including freelancers. As a freelancer, you do not have the benefit of an employer-sponsored retirement plan, such as a 401(k) or pension. However, there are still various retirement savings options available to you. Consider opening an Individual Retirement Account (IRA) or a Simplified Employee Pension IRA (SEP IRA), which allows you to contribute a portion of your self-employment income to a tax-advantaged retirement account. Additionally, you may want to explore other investment vehicles, such as a Roth IRA or a taxable brokerage account, to further grow your retirement savings.

Invest in Retirement Accounts

In addition to saving for retirement, it’s important to invest your retirement savings in order to maximize their growth potential. As a freelancer, you may have more flexibility and control over your investment choices compared to traditional employees. Research different investment options, such as stocks, bonds, and mutual funds, and consider working with a financial advisor to develop a diversified investment portfolio that aligns with your risk tolerance and long-term goals. By investing your retirement savings strategically, you can potentially generate greater returns and ensure a more comfortable retirement.

Health Insurance

Research Health Insurance Options

Health insurance is a critical component of financial planning, and it becomes even more important as you approach retirement age. As a freelancer, you will need to find and purchase your own health insurance coverage. Start by researching different health insurance options, such as private plans offered through the Health Insurance Marketplace or professional organizations, and compare their costs and coverage levels. Consider factors such as deductibles, copayments, and prescription drug coverage. It’s also important to evaluate whether your preferred healthcare providers are in-network. By thoroughly researching and comparing health insurance options, you can find a plan that meets your needs and fits within your budget.

Consider Supplemental Insurance

While basic health insurance coverage is critical, it may not cover all of your healthcare costs in retirement. That’s where supplemental insurance comes in. Consider purchasing supplemental insurance policies such as dental, vision, and long-term care insurance to provide additional coverage for services that may not be included in your primary health insurance plan. Dental and vision insurance can help cover the costs of routine check-ups, cleanings, and eye exams, while long-term care insurance can provide financial protection in the event that you require extended care in a nursing home or assisted living facility. By considering the need for supplemental insurance, you can better protect yourself against unexpected healthcare costs in retirement.

Plan for Healthcare Costs in Retirement

When planning for retirement, it’s important to factor in the costs of healthcare. Medical expenses can be one of the largest expenses in retirement, especially as you age and may require more frequent medical care. Take the time to estimate your anticipated healthcare costs in retirement, including premiums, deductibles, copayments, and prescription medications. It’s also important to consider the potential need for long-term care, which can be quite expensive. By planning for healthcare costs in retirement, you can ensure that you have enough savings and insurance coverage to handle these expenses.

Build Multiple Income Streams

Diversify Your Freelance Client Base

Building multiple income streams is a smart financial strategy for freelancers, as it can provide stability and security. One way to achieve this is by diversifying your freelance client base. Instead of relying on just a few clients for the majority of your income, consider working with a wider range of clients across different industries and sectors. This way, if one client reduces their workload or terminates their contract, you will still have other clients to rely on for income. Additionally, having a diverse client base can expose you to new opportunities and help you expand your professional network.

Explore Passive Income Opportunities

In addition to your freelance work, consider exploring passive income opportunities to further build your income streams. Passive income refers to money earned with little to no effort on your part. This can include income from rental properties, investments, or royalties from creative works. Passive income can be especially beneficial during retirement, as it can provide a steady stream of income that requires minimal effort or time commitment on your part. By exploring passive income opportunities, you can increase your financial security and create a more sustainable retirement plan.

Plan for Taxes

Understand Self-Employment Taxes

As a freelancer, it’s important to understand the tax implications of your self-employment income. Unlike traditional employees who have taxes withheld from their paychecks, freelancers are responsible for paying self-employment taxes, which include both the employer and employee portions of Social Security and Medicare taxes. Additionally, freelancers may be subject to additional taxes, such as estimated quarterly taxes and the Net Investment Income Tax (NIIT). By understanding self-employment taxes and properly planning for them, you can avoid surprises and ensure that you remain in compliance with tax laws.

Consult with a Tax Professional

Given the complexities of self-employment taxes, it’s advisable to consult with a tax professional who specializes in working with freelancers. A tax professional can help you navigate the tax code, identify deductions and credits that you may be eligible for, and optimize your tax strategy. They can also help you stay organized throughout the year by providing guidance on recordkeeping and tracking expenses. By working with a tax professional, you can ensure that you are maximizing your tax savings and minimizing your tax liability.

Develop a Retirement Exit Strategy

Plan for Transitioning Out of Freelance Work

While freelancing offers flexibility and independence, it may not be a sustainable career option as you approach retirement age. It’s important to develop a retirement exit strategy to ensure a smooth transition from freelance work to retirement. Consider how you want to phase out of freelancing and what steps you need to take to wind down your business, such as notifying clients, transferring projects, and closing business accounts. Additionally, think about the skills or expertise you have developed as a freelancer and how you can leverage them in a different capacity during your retirement years.

Consider Part-Time Work or Consulting

Retirement doesn’t have to mean completely giving up work. Many retirees choose to continue working in some capacity, either through part-time employment or consulting opportunities. These types of work arrangements can provide additional income, social interaction, and a sense of purpose during retirement. Consider what types of part-time or consulting work align with your skills and interests, and explore opportunities in your chosen field. By continuing to work in a reduced capacity, you can supplement your retirement income and stay engaged in the workforce.

Set Up a SEP IRA or Solo 401(k)

Learn About Retirement Account Options for Freelancers

As a freelancer, it’s important to explore retirement account options that are specifically designed for self-employed individuals. Two common options are the Simplified Employee Pension IRA (SEP IRA) and the Solo 401(k). A SEP IRA allows you to contribute a percentage of your self-employment income to a tax-advantaged retirement account. The Solo 401(k) is similar to a traditional 401(k) and allows you to make both employer and employee contributions. Each option has its own eligibility criteria and contribution limits, so it’s important to learn about the specifics of each retirement account option to determine which one is best for your needs.

Choose the Right Retirement Account for Your Needs

When selecting a retirement account as a freelancer, it’s important to choose the option that aligns with your financial goals and circumstances. Consider factors such as contribution limits, investment options, administrative costs, and accessibility of funds. Additionally, think about your retirement timeline and how much flexibility you need with regards to contributions and withdrawals. By choosing the right retirement account for your needs, you can ensure that your retirement savings are growing efficiently and that you have access to your funds when you need them.

Evaluate Insurance Needs

Assess Life Insurance and Disability Insurance Options

Insurance is an important component of a comprehensive financial plan, and as a freelancer, it’s crucial to evaluate your insurance needs. Life insurance can provide financial protection for your loved ones in the event of your death, while disability insurance can provide income replacement if you become disabled and are unable to work. Assess your financial obligations, such as mortgage payments and dependent care expenses, and consider how much coverage you may need. Additionally, evaluate the cost of insurance premiums and any exclusions or limitations. By assessing your life insurance and disability insurance options, you can ensure that you have the necessary coverage to protect yourself and your loved ones.

Consider Long-Term Care Insurance

Long-term care insurance is another type of insurance to consider as you approach retirement age. This type of insurance provides coverage for the costs associated with long-term care services, such as in-home care, assisted living facilities, and nursing homes. Long-term care can be quite expensive, and Medicare typically doesn’t cover these costs, so having long-term care insurance can help protect your retirement savings. Evaluate your family’s medical history, your overall health, and the potential cost of long-term care services in your area to determine if long-term care insurance is right for you.

Establish an Emergency Fund

Save for Unexpected Expenses or Income Fluctuations

Establishing an emergency fund is an essential part of financial planning for freelancers. As a freelancer, your income may fluctuate from month to month, making it important to have a financial cushion to cover unexpected expenses or income shortfalls. Aim to save three to six months’ worth of living expenses in your emergency fund. This fund should be easily accessible, such as in a high-yield savings account, and separate from your retirement or investment accounts. By having an emergency fund in place, you can weather financial storms and avoid unnecessary stress in the event of an unexpected expense or income loss.

Maintain 3-6 Months’ Worth of Living Expenses

When determining how much to save in your emergency fund, a general guideline is to aim for three to six months’ worth of living expenses. This should cover essential expenses such as housing, utilities, food, and transportation. However, the exact amount you need to save may vary depending on your individual circumstances and risk tolerance. Consider factors such as your monthly income, the stability of your freelance work, and any additional sources of income or support. By maintaining a robust emergency fund, you can have peace of mind knowing that you have a financial buffer to rely on in times of need.

Seek Financial Advice

Consult with a Financial Advisor

Managing your finances and planning for retirement can be complex, especially as a freelancer with unique financial considerations. Consider consulting with a financial advisor who specializes in working with freelancers. A financial advisor can help you create a comprehensive financial plan, evaluate your retirement savings strategies, and provide guidance on investment options. They can also assist with tax planning, risk management, and estate planning. By working with a financial advisor, you can benefit from their expertise and ensure that you are making informed financial decisions that align with your goals.

Educate Yourself on Retirement Planning Strategies

While working with a financial advisor is valuable, it’s also important to educate yourself on retirement planning strategies. Take the time to research and learn about different retirement savings options, investment strategies, and tax planning techniques. There are many resources available, such as books, online courses, and articles, that can help you build your knowledge and confidence in managing your finances. By becoming informed about retirement planning strategies, you can actively participate in your financial future and make well-informed decisions.

Stay Active and Engaged

Explore Hobbies and Activities to Stay Mentally and Physically Active

Retirement is a time to enjoy new hobbies, experiences, and activities. As a freelancer, you have the flexibility to structure your time and pursue activities that bring you joy and fulfillment. Explore new hobbies, such as painting, gardening, or playing a musical instrument. Engage in physical activities, such as walking, yoga, or swimming. By staying mentally and physically active, you can maintain a sense of purpose and well-being during retirement.

Find Volunteer or Part-Time Work Opportunities

Retirement doesn’t necessarily mean complete withdrawal from work. Many retirees find fulfillment by engaging in volunteer work or taking on part-time employment. Look for volunteer opportunities in your community that align with your interests and skills. Consider part-time work opportunities that allow you to utilize your expertise and stay engaged in your field. By finding volunteer or part-time work opportunities, you can continue to contribute to society, expand your social network, and add structure to your retirement years.

In conclusion, financial planning is crucial for freelancers as they prepare for retirement. By creating a retirement budget, saving for retirement, investing in retirement accounts, and planning for taxes, freelancers can build a solid financial foundation. Building multiple income streams, developing a retirement exit strategy, and evaluating insurance needs further contribute to a secure retirement. Establishing an emergency fund, seeking financial advice, and staying active and engaged in retirement are additional important considerations. By following these steps and taking the time to plan ahead, freelancers can enjoy a financially secure and fulfilling retirement.