Have you ever wondered how you, as a freelancer, can better manage your taxes, especially as the year winds down? With the business landscape continuously evolving and a growing number of individuals stepping into the freelancing arena, tax planning has become more crucial than ever. This guide will walk you through effective tax strategies that will help you prepare for the fall season and make tax time less of a hassle.

Understanding Freelance Tax Obligations

As a freelancer, you’re not just an independent worker; you’re also running a small business. This means you’re responsible for paying self-employment taxes, including Social Security and Medicare. This is typically around 15.3% of your net earnings. Additionally, you might need to make quarterly estimated tax payments to the IRS. Many freelancers underestimate their tax liability, which can lead to surprises at tax time.

Self-Employment Tax Basics

Self-employment taxes cover your contributions to Social Security and Medicare. Unlike traditional employees who split this cost with their employers, you pay the entire 15.3% yourself. It’s important to accurately calculate this based on your net income to avoid underpayment penalties.

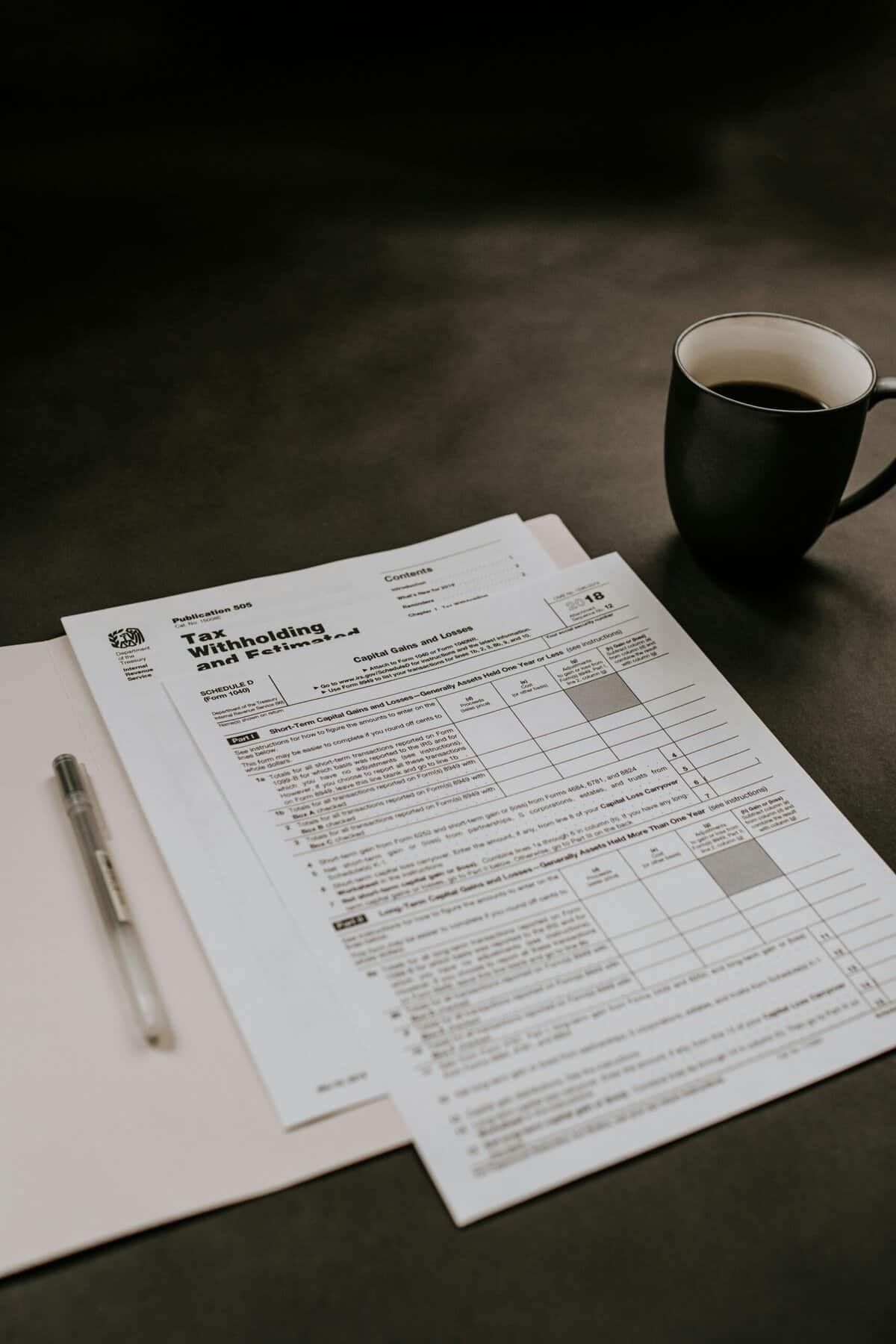

Quarterly Estimated Taxes

Since you’re not withholding taxes from a regular paycheck like traditional employees, you’re expected to pay taxes in quarterly installments based on your expected annual income. Missing payments can result in penalties, so marking these dates on your calendar is crucial.

| Payment Period | Due Date |

|---|---|

| January 1 – March 31 | April 15 |

| April 1 – May 31 | June 15 |

| June 1 – August 31 | September 15 |

| September 1 – December 31 | January 15 (following year) |

Valuable Tax Deductions for Freelancers

Deductions are your best friend when it comes to reducing your taxable income. As a freelancer, you have the potential to claim numerous deductions, provided you maintain thorough records throughout the year.

Home Office Deduction

If you use part of your home exclusively for business, you can claim a portion of your rent, mortgage, utilities, and home insurance. The IRS offers a simplified option that allows you to deduct $5 per square foot, up to 300 square feet, making it easier for those who don’t want to track every expense.

Equipment and Software Costs

From computers to specific software subscriptions, many tools you use for work can be deducted. Keep receipts and consider utilizing accounting software to track these expenses throughout the year.

Professional Development

Attendance at conferences, online courses, and certifications directly related to your freelance work can be deducted. Continuing education not only fosters career growth but also provides valuable tax breaks.

Health Insurance

You may deduct your health insurance premiums if you’re self-employed. This deduction applies even if you don’t itemize deductions on your tax return.

Building a Tax-Resilient Freelance Business

Being proactive is key to managing your tax obligations efficiently. Setting up a system to track your income and expenses is indispensable.

Setting Up a Business Bank Account

Separating your personal and business finances simplifies tax preparation and helps maintain accurate records. A dedicated account for your freelancing finances ensures that you can easily access all necessary details when it’s time to file taxes.

Utilizing Accounting Software

There are many software options designed for freelancers that allow you to track expenses, send invoices, and manage receipts. These tools can significantly streamline your bookkeeping process and prepare you for tax season, making them a worthy investment.

Retaining Financial Documents

The IRS requires you to keep records for at least three years after filing your tax return. Keep digital copies of your receipts, invoices, bank statements, and any other documents that support your income and deductions.

Strategic Fall Tax Planning

Fall is a strategic time to review your finances and plan for the year-end tax implications. Taking a moment to fine-tune your approach now can save you both time and money come tax season.

Conducting a Mid-Year Financial Review

Evaluate your earnings and expenses to date. Adjust your quarterly payments if necessary. This review will help you avoid any surprises when April 15th arrives.

Evaluating Retirement Contributions

If you haven’t yet contributed to a retirement account, fall is a great time to start. Contributions to traditional IRAs and SEP IRAs are tax-deductible, thereby reducing your taxable income.

Projecting Year-End Purchases

Consider any last-minute business purchases that may offer tax benefits. This could include equipment you’ve been eyeing for your freelance work or prepaying for courses or subscriptions.

The Role of a Tax Professional

While handling taxes on your own might be feasible, hiring a tax professional can alleviate stress and ensure accuracy.

Hiring a Tax Professional

A licensed CPA or tax advisor familiar with freelancing intricacies can not only aid in precise tax calculations but also provide strategic advice to optimize your financial standing. They can identify nuances that may not be obvious and help mitigate future tax liabilities.

Regular Consultations

Even if you’re not ready to hire an accountant full-time, regular consultations can offer you peace of mind and the professional guidance necessary to keep your financial planning on track.

Staying Informed About Tax Law Changes

Tax laws are frequently updated, which can affect how you manage your finances. Staying informed ensures you’re compliant and taking advantage of any new benefits.

Leveraging Reliable Resources

Subscribe to newsletters or join forums that focus on freelancer tax advice. Websites like the IRS or financial news outlets can keep you updated on relevant changes that could impact your tax strategy.

Networking with Other Freelancers

Join freelance groups or associations where members share insights about the industry, including tax planning. Networking can provide valuable, real-world advice that textbooks or articles may not cover.

Conclusion

Freelancing offers flexibility and independence but brings with it unique financial responsibilities, especially in the realm of taxes. By understanding your obligations, leveraging deductions, planning strategically for fall, and seeking professional advice when needed, you’ll be well-prepared to handle tax season with confidence. Remember, the more informed and proactive you are, the smoother your tax experience will become. Here’s to a stress-free tax season ahead!